Canada is one of the best places for international students who want to study in a safe and welcoming country....

Why College is Worth the Cost

College is becoming more expensive each year, and many students are taking on loans that will take decades to repay. As a result, the question for many is whether having a degree is the right thing to do. This is because the cost of college would pay off much more in some jobs, but in others, college graduates may find there is not much pay difference.

Polls indicate that Americans are no longer sure college is the right choice for everyone. In this paper, we will discuss the costs, the benefits, public perception, alternatives, and how a family can determine the best option for their working lives.

Table of Content

ToggleThe Price of a College Education

College has emerged as one of the largest expenditures most families incur. Public colleges cost about $11,000 per year or less on average in 2024-2025, provided you live in the same state. The cost is higher or lower depending on whether you are in-state or out of state. In-state, it will cost you less or about $24,000.

The highest tuition fees are charged by private colleges, at about $43,000 per annum, which can affect the financial situation of college graduates. That is simply tuition. There are other payments students must make that raise the actual price significantly. Among the most significant add-on costs are:

- Housing and meals, often $10,000-$15,000 each year.

- Textbooks and supplies, around $1,000-$1,500 annually.

- Campus and lab fees, sometimes several thousand more.

In college, four years cost more than $100,000. Most families do not have the money to pay for this, and thus, the student or high school graduates will borrow money. In the United States, student loan debt has soared to approximately $1.8 trillion, with the average wage of average student graduating with a debt burden of approximately $30,000.

Interest compounds itself into the sum, and several college graduates take 10-20 years to repay the loan. In the process, the loan payments constrain their ability to purchase a vehicle, save down payment on a house or accrue savings, among other possibilities. That is why so many families are ceasing to ask whether college costs align with the benefits.

Financial Benefits of a College Degree Program

Among the main reasons people desire to attend college is the opportunity to earn higher earnings and financial salaries during their working period. In 2023, visionary people with a bachelor’s degree received approximately $1,493 per week and people with a high school education or without it received only $899.

According to the U.S. Bureau of Labor Statistics (BLS), the difference translates to more than $30,000 every year. Think of two friends, one of them college-educated and one who was not. On reaching the age of 40, both of them might have a considerable difference of hundreds of thousands of dollars that they earn. That gap adds up to nearly a million in a lifetime. This is the comparison in numbers:

| Education Level | Unemployment Rate | Typical Job Paths | Job Stability in Recessions |

| High school diploma | 3.9% | Retail, construction, service jobs | Higher risk of layoffs |

| Bachelor’s degree | 2.2% | Healthcare, business, engineering | Lower risk of layoffs |

Money isn’t the only part of the story. People with degrees are less likely to lose jobs during hard times like recessions, which can impact unemployment rates. They often find new jobs faster, too, which makes it easier to plan big steps like saving for a house or starting a family. But not all college education degrees bring the same income.

Engineering graduates often pass $100,000 a year once they are established, while people in social services may earn closer to $50,000-$60,000. Technology is also shaping how students prepare for careers.

For example, psychology students use AI for psychology to study complex topics and practice research skills. These tools can give them an edge in school and later in the workplace, which adds to the long-term value of their degree. A college diploma doesn’t guarantee wealth, but it usually means higher pay, steadier work, and more financial choices than stopping after high school.

Non-Financial Reasons College Still Matters

The benefits of college cannot be seen purely in financial terms. A degree also supports personal growth, forming time management skills, connections, and habits of everyday life. Such advantages might not be reflected in the paycheck, but nevertheless, they influence stability along the lines and decisions. Some important advantages are as follows:

- Skills for work and life: College education helps people practice problem-solving, leadership, and clear communication. These skills are useful in many jobs and daily situations, such as managing a household budget or working with a group.

- Networks and connections: Colleges often connect students with alumni, professors, and employers. These ties can lead to job offers, internships, or career advice that would be unavailable otherwise.

- Community impact: Research shows graduates are likelier to vote, volunteer, and support local programs. They are also more likely to participate in public discussions and bring new ideas to their communities.

- Stability in life: Data links college completion with lower poverty rates, better access to health insurance, and more retirement savings.

Beyond these points, college also affects how students learn and grow during their studies. Science majors, for instance, can solve biochemistry with AI, which helps them tackle complex topics and practice skills they will need later in their careers. This kind of support makes it easier to succeed in school and shapes habits like persistence, problem-solving, and independent learning. These non-financial benefits show that a higher education college education is about future paychecks and building a foundation for long-term growth and stability.

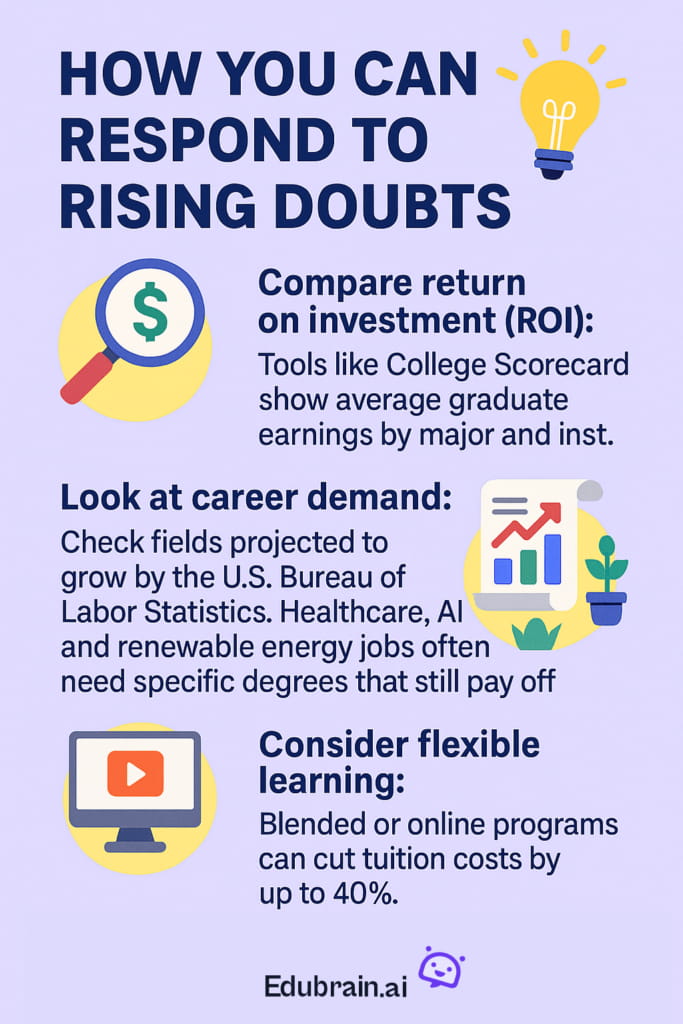

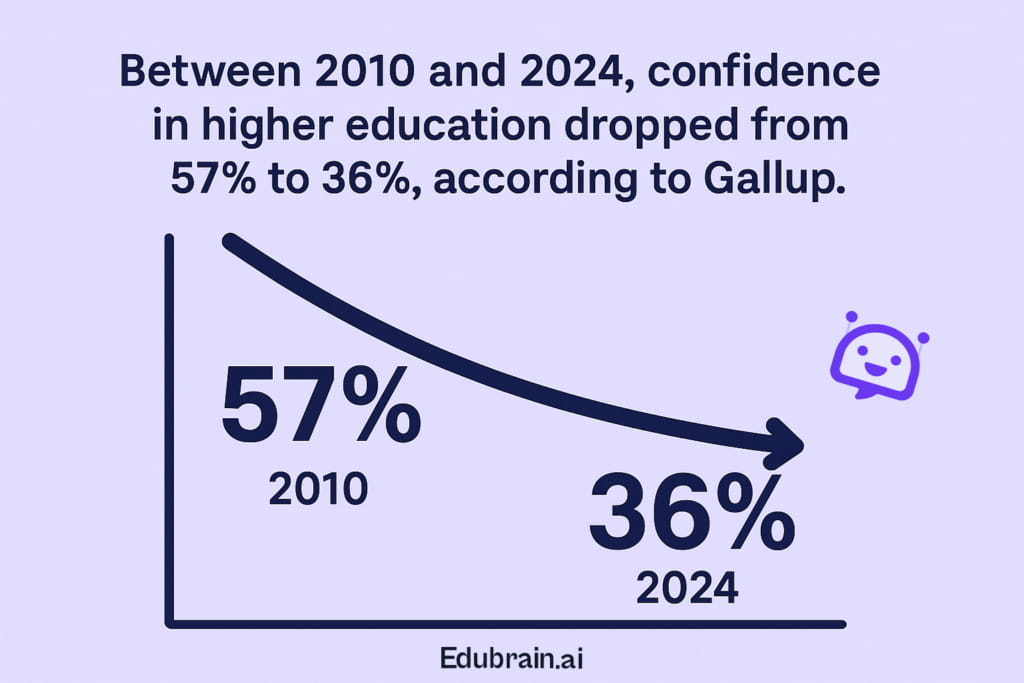

Doubts About the Value of College Grads

Confidence in college has been falling across the United States. Gallup and the Pew Research Center surveys show that fewer college students believe a degree is the best path to success. One Pew study found that only 22% of adults think a four-year degree is worth the price if loans are needed.

Almost half said it only makes sense without borrowing, and about a third said it is not worth it. These numbers reveal how much the rising cost of tuition and debt has shaped public opinion in recent years. The divide also shows up in politics and personal experience:

- Republicans are more likely than Democrats to say college is less important today than in the past.

- Around half of Republicans say a degree is “not too essential” or “not important at all” for landing a good job.

- Even among graduates, many feel unsure if their own degree paid off.

Students are also finding cheaper ways to keep up with their studies. Some use EduBrain AI and other data sources to practice class material, prepare for exams, and get explanations that clarify complex subjects for most students. Choosing this kind of support shows how cost-conscious families try to balance the high price of college with the need for prospective students to succeed while they’re still in school.

Alternatives to Four-Year Degrees

Not every student needs or wants a four-year degree. Community colleges give an affordable start, with tuition much lower than universities. Many students use them to earn an associate degree or to help high school graduates complete the first two years of general courses before transferring to a university. This path can cut the overall cost of a bachelor’s degree in half.

Vocational programs focus directly on job skills. Nursing, welding, cosmetology, and IT certifications are standard options. These programs often last one to two years, preparing people to step into jobs right after training. Apprenticeships add another choice, mixing classroom lessons with paid on-the-job work. For example, someone training as an electrician or mechanic can earn money while gaining experience. This model is especially useful for people who cannot afford years of school without income.

Employers are also shifting toward skills-based hiring. Tech companies, hospitals, and manufacturers often accept certifications or proof of ability instead of requiring a diploma. A student interested in science might practice with an organic chemistry AI solver, strengthening their knowledge without paying for extra classes. Options like these show how education and training can take many forms, and how students can build careers without always committing to four years at a university.

How Families Can Weigh Costs vs. Benefits

The cost of college means families must look at the net price, total and not just the tuition. There are costs of housing, food, books, tuition and fees, and it can add thousands of dollars a year. Once the real cost is estimated, it has to be compared with the probable income by field.

It is evident from the labor statistics data provided by the Bureau of Labour Statistics and the College Scorecard. Engineering students can command an average salary of about $80,000 at graduation, whereas social services students expect entry-level pay of about $40,000. Another determining aspect is the making of debt repayments. Along with interest, a 10-year or more cycle can be used to pay off a $30,000 loan and increase the sum. Some of the points that families need to consider are;

- Total cost of tuition, housing, and fees.

- Average salary by major or career path.

- Size of loans and repayment time.

- Value of grants, scholarships, and aid.

- Non-financial gains such as skills and networks.

Education also shapes life beyond income. Jobs that require a degree are more likely to come with benefits such as health insurance and retirement plans. Families also look for ways to manage learning costs while in school.

Many students reduce extra expenses by relying on online study support, and some turn to astronomy homework help to get through difficult science courses without paying for private tutors. Balancing these financial and non-financial factors, including long term benefits, gives a clearer picture of whether a degree is the right path.

Is College Worth the Cost?

There is no one answer to whether a degree is worth money. The amount varies according to the course area, the price, and the financial status of every student pursuing advanced degrees. Graduates with a bachelor’s degree in engineering or computer science usually get salaries that allow easier loan repayment.

Individuals in lower-paying disciplines such as social services may be saddled with the same level of debt, but few prospects of paying it off rapidly. This disparity accounts for why some families view college as a good investment, whereas others are conservative.

Money is not the only parameter. A degree, often part of the college experience, is frequently the door to employment, offering health insurance, retirement benefits, and more secure work. Long-term prospects are also possible with the help of institutional aid and networks established by professors, classmates, or alumni.

Meanwhile, other pathways into the labor market do not require as much debt to be undertaken by the student, such as community college, vocational training, and apprenticeships. College can and should be useful when price is moderated versus purpose, but it does not always make the best choice on every road.

Explore Similar Topics

Homework has been a cornerstone of education for generations. It has sparked endless debates among educators, parents, and students. Some...

Are you a high school student curious about chemistry? Many summer programs are available to help you explore this exciting...